Q3 Bank Earnings Preview and Why We’re Approaching a New Bank Stock Investment Cycle

The bank stock roller coaster ride continued during Q3. Bank stock performance during the third quarter seemed to validate both the hopes and fears of just about all market observers. …

Read more

Bank Board Insights Series Part IV: Are Bank Boards Risky Enough?

In light of the collapse of Silicon Valley Bank which has been widely attributed to the absence of bank risk management, we had a theory that Bank Board expertise in…

Read more

From Retirement Dreams to CFO Reality: 5 Insider Tips for Successful Succession Planning

Since 2020, over 60% of Travillian’s talent mandates have been in the offices of the CFO or CRO. Stop me if you’ve heard this before, but risk and finance talent…

Read more

Community Bank CEOs Q&A with Cushman & Wakefield: A Deep Dive of Facts, Stats and Key Trends in CRE

View the Cushman and Wakefield full slide deck, here. Commercial Real Estate (CRE) has been a frequent topic in recent headlines, with concerns about navigating potential issues related to CRE…

Read more

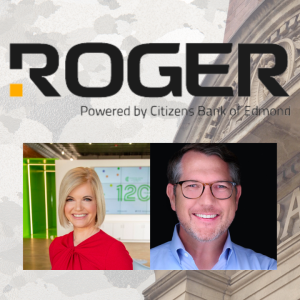

The Road to Roger: Launching a Digital Bank, a Conversation with Jill Castilla & Jeffery Kendall

Jill Castilla, President and CEO at Citizens Bank of Edmond ($375M in Assets / Edmond, OK) is a Veteran, military mom and military spouse. Besides her role as CEO at…

Read more

Navigating Challenges: A Candid Discussion with ICBA Panelists on the Vital Role of Community Banks

Exploring the resilience of community banks amid macroeconomic pressures, we had an enlightening discourse with ICBA Panelists. We welcomed ICBA (Independent Community Bankers of America) – ardent advocates for community…

Read more

Tech-Bank Reality Is More Nuanced Than Negative Headlines And Sour Sentiment Would Suggest

“History never repeats itself, but it does often rhyme.” -Mark Twain It’s been a rough couple of years for Fintech and many Fintech-affiliated banks. Valuations for pure Fintech companies peaked…

Read more

Never Underestimate the Power of Simplicity: A Conversation with InterBank’s President, C.K. Lee

With an incredibly diverse past in investment banking, private equity, and bank regulation, InterBank’s President and COO, C.K. Lee, is one of the industry’s most well-rounded executives. He joined InterBank…

Read more

Pioneering the Future: The Confluence of Technology and Banking

It’s been a while since our last additions, but we are thrilled to introduce three new visionary banks to the Travillian Tech-Forward Bank Index by hosting an engaging group discussion with a…

Read more

From Pens to Pixels: Maximize Your Marketing Efforts for Customer Growth

Gone are the days when a few pens and local newspaper ads suffice for marketing in the banking industry. In today’s digital era, analytics and technology have become the backbone…

Read more

Mission: Partnerships – Alignment of Talent, Culture and Tech Allow Banks to Do the Impossible

Missed out on our live webinar last week? No worries! Catch the recording anytime on Travillian Next, where we discussed critical issues facing community banks and credit unions, including fintech…

Read more

It’s Time for the Tough to Get Going: Banking in 2023 – An Investment, M&A, and Regulatory Perspective

Recent developments in the bank sector have led to confusion and uncertainty about the road ahead. In this wide-ranging and timely discussion with Travillian’s Head of Banking and Fintech, Brian…

Read more

A Banking & Fintech PR Perspective: People & Communication Make the Bank Go Round

Scott Mills, the President of the highly renowned William Mills Agency, stands at the helm of one of the most prominent public relations and marketing firms specializing in the financial…

Read more

Governance, Risk & Compliance (GRC) 2.0: The Future of Organizational Excellence Starts Now

The Significance of GRC: Navigating Risk and Compliance in Banking Governance, Risk, and Compliance (GRC) is a comprehensive approach that unifies various organizational functions, such as governance, compliance, risk management,…

Read more