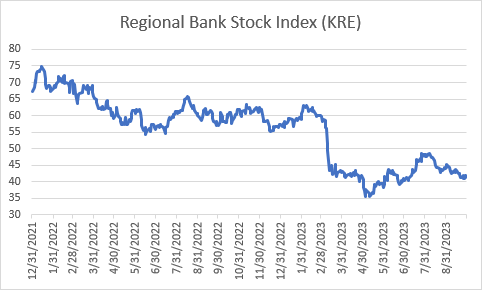

The bank stock roller coaster ride continued during Q3. Bank stock performance during the third quarter seemed to validate both the hopes and fears of just about all market observers. Bulls were heartened early on by a stunning 19%+ advance in the bank stock index in July, the strongest monthly gain since the COVID-19 vaccine announcement in November 2020. The bears then had their day in the sun, as bank stocks declined by just over 14% over the last two months of the quarter, following downgrades from credit ratings agencies, and a sharp increase in market interest rates, challenges that led to renewed concerns around funding, liquidity, and credit, but didn’t quite rise to the level of panic witnessed earlier this year. In the end, the bank stock index ended the quarter only slightly higher than where it began but outperformed the broader financial sector and stock market on a quarterly basis for the first time in a year. A victory, to be sure, but a modest one at that, considering that the index as of the end of the third quarter was down nearly 30% for the year, and by nearly 50% from the peak level achieved early in 2022, the start of what has been an exhausting bear market now approaching its two year anniversary.

A bumpy road likely still ahead… Even after a punishing decline, the bear case on bank stocks is still relatively easy to defend. Interest rates have surpassed prior highs for this cycle, and seemingly will remain “higher for longer”, pressuring funding costs, compressing net interest margin, and impairing asset values. On the asset quality front, if the Fed is to succeed in its mission to drive inflation down to targeted levels, an economic “hard landing” could possibly result, particularly in a “higher for longer” scenario, threatening consumer, business, and real estate credit, and combined with other factors, eroding bank capital. The bears will also contend that stocks are cheap but deservedly so, given continued investor apathy, and could represent a value trap, should earnings remain under pressure through next year and fall short of Street expectations, denting the bull case on valuation. Finally, from a geopolitical standpoint, it goes without saying that the current period is among the most fraught in recent memory, with yet another overseas conflict erupting as this article goes to print, further clouding the outlook for risk assets.

…but were buyers of bank stocks ahead of Q3 reporting season. All that said, we’re taking a more constructive view of bank stocks, we’re buyers ahead of earnings season, which kicks off later this week, and we believe we’re approaching the early stages of a new bank stock investment cycle. There are several reasons for our optimism:

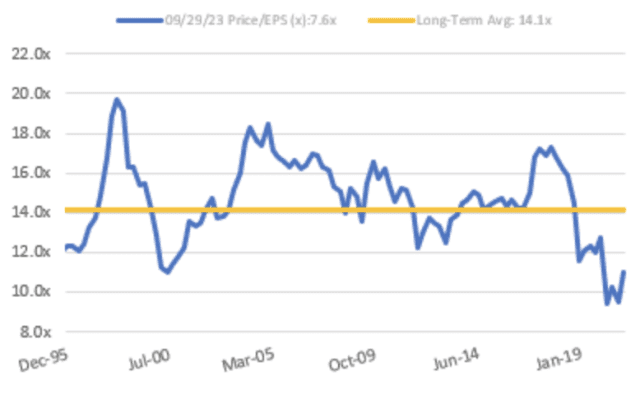

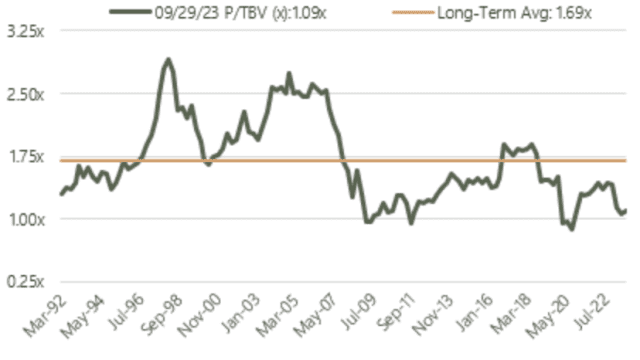

First, and most simply, the stocks are historically cheap and have discounted quite a bit of potential “bad” news. We’re admittedly a bit reluctant to lead with the valuation argument, as it’s typically an unreliable near-term catalyst for stock prices. But it’s becoming increasingly hard to ignore just how cheap these stocks are from a historical perspective. Bank stocks today trade at just under 8x the forward consensus EPS forecast, a discount of roughly 46% to the average over the past three decades. When measured on a tangible book value basis, stocks trade at just 1.1x, a 35% discount to the three decade average. And as compared to the broader market, bank stocks trade at less than 50% of the S&P multiple, compared to the long-term average of just over 80%.

Now, to be clear, our relative optimism on the stocks shouldn’t be interpreted to imply that we think investors will be wowed by the coming update on bank sector fundamentals. Most banks (especially the smaller ones) are likely to report that margin compression will extend into the first half of next year, we’re likely to hear about more “one-off” credit charges as measures of asset quality continue to normalize, and earnings forecasts for next year are likely to be ratcheted lower, as bank management teams begin to provide an early glimpse of their expectations for next year. But while the update is likely to be less than inspiring, it’s difficult for us to believe that anything short of outright disastrous results isn’t already contemplated in current trading multiples. Moreover, while we await the turn, we note the sector’s attractive dividend yield, at roughly 4.5%, adding yet another key element to total return potential from current levels.

Price-to-Forward Earnings

Price-to-Tangible Book Value

Second, behind the scenes, we note some encouraging macro developments. While the headlines and certain developments, including the sharp rise in long-term interest rates, continue to spook investors, we see a few other less-heralded developments as having the potential to alter the narrative (in a good way) around the stocks. By all indications, the Fed is nearing the end of its rate-hiking cycle, which should, at the very least, stabilize short-term rates, and possibly drive them lower, as the market anticipates an eventual pivot (even if it’s likely further out than consensus currently believes).

At the same time, without getting into the hairy details, certain dynamics, including greater-than-expected Treasury issuance (the highest in recent history ex-2020), a recently accelerated pace of quantitative tightening, and the resiliency of the economy, have driven long-term interest rates appreciably higher. While this carries risks of its own (mostly to asset quality and liquidity), an underappreciated positive result is less inversion of the yield curve, which has arguably been the most significant overhang on bank stock performance since the start of this bear market. Indeed, the negative spread between 2-year and 10-year Treasury rates has quietly declined from nearly 110 basis points at the end of Q2 to roughly 30 basis points in recent weeks. Should these conditions hold and the Fed were to confirm that it’s rate hiking cycle is on pause or has ceased entirely, sentiment, particularly amongst generalist investors, should improve, as investors anticipate a potentially more favorable yield curve set-up and stable, and eventually improved net interest margins. At recent investor conferences we attended, we noticed early signs of improved sentiment, as attendance at both conferences was reported to be up by over 30% from last year.

Third, we anticipate normalization – not devastation – of asset quality. Another persistent overhang on bank stock performance has been fears around credit degradation following a long period of benign credit conditions. A litany of recently reported so-called “one-off” credit charges would seem to suggest that we’re at the front end of a cycle of emerging credit problems. While it’s certainly possible that more menacing trouble lurks around the corner, we suspect that this rush to judgment more reflects investors’ experience during the last credit cycle than it does the reality today on the ground. In other words, lingering memories of the 2008 experience is informing the market reaction today as to what may potentially lie ahead.

We take issue with that assumption, for several reasons. First, we believe credit underwriting (and the regulatory scrutiny of it) heading into this cycle is vastly improved as compared to the last one. Second, we think a good portion of the exposure to office real estate in major metro urban areas, likely the most problematic asset class of this cycle – is held outside the regulated banking system, and to the extent that banks are exposed to large office towers, it’s primarily the largest banks, which are best equipped in this cycle to absorb any major fall-out. Third, unlike in 2008, when the largest banks were at the forefront of the major problems, they are beacons of safety and soundness in this cycle, virtually eliminating the possibility today of true systemic risk emanating from a credit cycle the way that it did the last time. Finally, the new CECL accounting standards – which weren’t in place in the last cycle – requires banks to anticipate future credit losses over the lifetime of the loan, and to reserve for deteriorating macroeconomic conditions in advance. So to the extent that credit proves worse than expected, banks will have already accounted for a portion of the reserves required to address the issue. In the event, as we expect, that credit simply normalizes, we wouldn’t anticipate much change at all to current reserve levels. The bottom line is that while we’re certainly watching it closely, bank stock valuations already seem to contemplate the potential for credit devastation ahead – in other words, credit devastation is just about priced in, whereas credit normalization is not, creating a favorable risk/reward dynamic.

Fourth, we see a massive consolidation wave as a question of “when”, not “if”. The considerations driving the multi-decade consolidation wave in banking – notably the need for scale, the increased cost of technology and requisite managerial expertise, a lack of sufficient talent, aging senior leadership (average bank CEO age is 61) and succession planning, and an increased regulatory burden, remains very much intact. That said, the disruption from extraordinary events, beginning with the pandemic nearly four years ago, has slowed the pace of (but not the need) for M&A. Importantly though, disruptions in recent years likely haven’t cancelled sale plans; for most banks, they’ve simply been delayed while the backlog of deal announcements continues to build.

In the very near-term, impediments to a meaningful pick-up in M&A are admittedly formidable, and include purchase accounting considerations, challenging deal math given depressed valuations and rate marks, uncertainty related to the regulatory approval process, and the overhang of potential recession and associated credit deterioration. But even if forestalled for a time, we see a massive consolidation wave as inevitable.

Periods of consolidation historically have proved beneficial to bank stock prices, in the sense that M&A pricing tends to re-establish franchise value for comparable companies across the bank sector following a crisis. We have no reason to believe this cycle will be different. That being said, the lack of M&A activity coupled with muted sentiment has resulted in the complete erosion of any takeout premium in the vast majority of the companies that we would consider to be potential targets (and valuable ones at that). We would also recommend focusing attention on the intelligent acquirers, as the earlier stages of an M&A wave typically favors the acquisitive companies, given first mover advantage on pricing, and the potential in this cycle for deals to pencil out even more attractively over time, as balance sheets at the targets are remixed, and a more hospitable rate environment is contemplated, providing a tailwind to book value growth and earn back periods in the out years.

Joe Fenech is the Managing Principal of SMBT Consulting, LLC, which provides consulting services to banks. The article represents the views and beliefs of Mr. Fenech and does not purport to be complete. The information in this article is provided to you as of the dates indicated and the data and facts presented herein may change. You should not rely on this article as the basis upon which to make an investment decision; this article is not intended to provide, and should not be relied upon for, tax, legal, accounting or investment advice. Mr. Fenech is also the Chief Investment Officer and Managing Member of GenOpp Capital Management LLC, an investment adviser that maintains exempt reporting status in the State of Indiana. Affiliates of SMBT Consulting, LLC may recommend to such affiliates’ clients the purchase or sale of securities of companies discussed in articles published by SMBT Consulting, LLC.