The Travillian Group hosted three top Southwestern-focused depository investment bankers. They discussed trends within the Southwest and the community banking landscape nationally.

Our panelists covered topics including: M&A / Industry Consolidation, Capital Markets – Sub-debt / Equity Issuance, “New Normal” Post-COVID, Talent, Southwest Regional Outlook, Regulation, FinTech and Succession Planning.

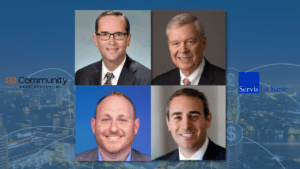

Panelists:

Kade Machen, Managing Director, Financial Institutions Group, Stephens

Christopher Murray, Managing Director, Financial Institutions Group, Piper Sandler

Dan Bass, Managing Director & Head of the Southwest Region of Investment Banking, Performance Trust Capital Partners

Kade Machen, Managing Director, Financial Institutions Group, Stephens

Christopher Murray, Managing Director, Financial Institutions Group, Piper Sandler

Dan Bass, Managing Director & Head of the Southwest Region of Investment Banking, Performance Trust Capital Partners