“The world has a habit of going on.” – Woodrow Wilson

Backdrop

Investors spent the last few years debating the cause of the next economic cycle. With all the possibilities, a virus resulted in ~40 million people losing their jobs in just three months (more than one in four workers from peak employment in February). Ridiculous. For those comparing to the last cycle, 37.1 million jobless claims occurred in the 2008-2009 cycle, albeit spread over a longer time frame.

Uncertainty Reigns

Anyone’s guess as to the speed and shape of a recovery from here is more of a guess than usual. This is the problem. A second wave of COVID infections could result from quarantining fatigue, protests, or it might just return with a vengeance in the fall. Only 5% of the U.S. population has been infected; we are far from “herd immunity”. I do feel confident stating GDP growth in 21’/22’ will not be consensus expectations of 4.7%/3.1% after declining ~6.5% in 20’; it will likely be much stronger…or weaker. The risk of the country completely shutting down again is low, but employment growth could be difficult for years. A “W” recovery also leaves us concerned about the durability of many small businesses in the U.S.

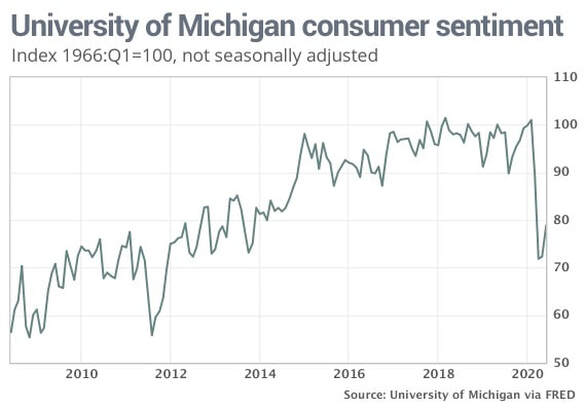

The economy bottomed in May and is starting to show signs of improvement. Retail sales roared back after a precipitous decline in April; how much was a function of pent-up demand is a fair question. Trucking data remains abysmal, and many other indicators remain highly recessionary. I think the Fed, in its wisdom of indicating zero rates through 2022, gives an indication of their modeling. By the way, ouch for the industry’s NII outlook…at least Chairman Powell was willing to say negative rates are not appropriate for the country. Fed funds were at zero between late 2008 until late 2015, but there was more of an interest rate curve. The backdrop/speed of industry changes was also less prevalent compared to the present.

Tough Task for Banks

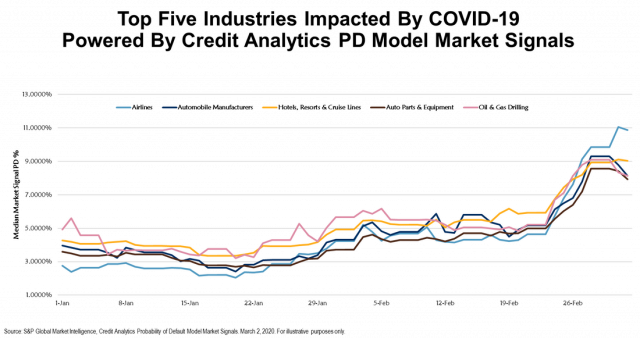

The difficult question for banks remains how to gauge potential credit losses from various segments of loan portfolios. NPAs for many industries will likely not emerge until 3Q/4Q; many business models were not well-positioned for social distancing (boutique gyms, full-service restaurants, etc.). Who would have ever thought the RV business would do so well in a recession?

Banks at this point are probably tired of sell-side equity research stress tests illustrating loss rates from the last downturn to current portfolios, but investors like low levels of uncertainty. This is one reason banks have lagged the S&P 500 (-4% YTD) by -25%. Between 2Q08 and 2Q12, banks with less than $5B in assets charged off an average of 5.1% of loan portfolios, with C&D being the biggest issue (11%). The risk in this cycle clearly appears to be small C&I and retail CRE, although all loan segments could be impacted. Besides the inherent risk of the loan portfolios, what quickly becomes obvious in stress testing is how important capital levels are and how important pre-provision earning power becomes (to protect existing equity).

Banks Are Indeed Better Positioned This Time, But Every Cycle Has Challenges

Banks are more insulated this cycle because of higher capital ratios, better underwriting, and less concentration in riskier assets generally. Tier 1 capital and total risk-based for public banks in 1Q20 were 11.9% and 13.7%, or 70bp higher each relative to 1Q09. Underwriting will always matter. In discussions, I have talked to banks with shopping centers that have been on special mention, but no loss will occur on disposition due to ~50% loan to value ratios. The bottom line is capital and underwriting will matter the most, but NCOs are tough to avoid on enterprises/properties whose underlying business trends may be negatively impacted…for years.

What to Do

I think banks should look at multiple scenarios on credit quality given the uncertainty. As an example, one regional bank in “SEC land” passes our own credit quality stress test with over $400M of excess capital (over 10% total-risk based) in a base case, but needs $100M of capital to remain well-capitalized under our “COVID-lingers” scenario. Raising capital before it is obvious a hole exists determines whether current shareholders can ever get back to break-even. Some institutions seem to be comfortable with capital given present pre-provision earning power and the supposed short-term nature of the economic cessation. I think it makes a ton of sense to at least consider sub-tier debt and other balance sheet strategies to protect the shareholder base from dilutive capital raises…if this recovery takes longer than expected and credit starts to exhibit more than temporary weakness. M&A will eventually also come back; I hear from virtually all my bank contacts that they are not considering anything, whatsoever, this year.

Hard Questions to Be Asked

While investors will have to again be patient through 2Q earnings season for better visibility of earning power (and credit ramifications) later in the year, two questions are worth asking of a bank’s portfolio:

- How are you helping clients with their liquidity base, and how long can they hang on without needing something besides short-term deferrals and government help?

- How much of the portfolio is still on deferral after the standard 90 days? What do the conversations look like around resumption of payments?

Last Thought – The Whole Franchise

Given the pass investors are currently giving the industry, now seems like a good time to put the institution on the white board and think about the future…hard. For those willing to make difficult decisions about legacy operations relative digital delivery channels, the path to a stronger competitive position post COVID will be more obvious.

“If you want to make enemies, try to change something.” – Woodrow Wilson

Travillian’s Banking and FinTech Practice provides Search and Talent Advisory services to depository institutions across the country. Established in 1998, the firm has built a unique platform that touches every corner of the industry. To learn more, click here, or get in touch below!

|

Brian Love, Head of Banking & Fintech

(484) 680-6950 | blove@travilliangroup.com |