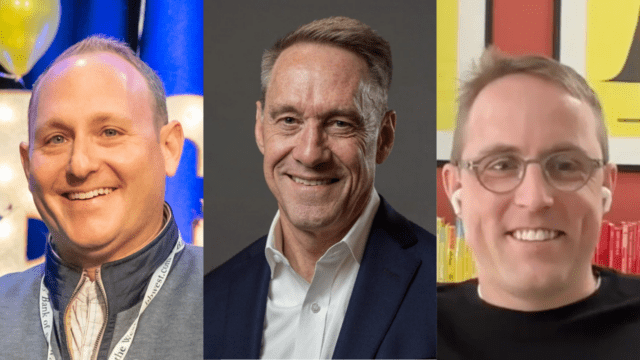

Join Brian Love, Head of Banking & Fintech at Travillian, for a brief yet enlightening Q&A session with frequent Travillian Next contributor, Scott Hildenbrand, Head of Piper Sandler Financial Strategies.

Brian and Scott discuss the latest trends in banking, the impact of the strong economic environment on optimism, the challenges community banks faced in 2023, and strategic moves for 2024.

Scott shares his expert views on deposit generation, talent demands in the finance sector, and the future of M&A, while Love adds his perspective on deposit strategies and the importance of the right infrastructure for banking relationships.

Brian Love: You once told me that “you’re probably in more board and ALCO rooms than anybody”… what are you hearing out there? How exactly has the tenor changed over the last 12-18 months? What, if anything, is creating optimism?

Scott Hildenbrand: The strong economic environment driving ‘higher for longer’ is a source for optimism, as credit costs have remained manageable thus far. If this turns, given current challenges around profitability, there could be less cushion to endure a downturn. There is a general feeling that the lag in rising cost of funds has caught up, and further NIM compression is unlikely. On the flip side though, if and when rates fall, how aggressive can banks be in reducing cost of funds given liquidity profiles and demand for deposits? An eventual return to a normalized curve is another reason to be optimistic.

Brian Love: Obviously 2023 was a challenging year for community banks. How have the first 6 months of 2024 gone from a balance sheet strategy perspective? What are banks doing to harbor the storm and prepare for the future?

Scott Hildenbrand: There are holes – legacy assets are hanging on balance sheets and not going anywhere soon – squeezing margins. Companies that figure out how to patch those holes (take losses, raise capital, sale leaseback, sell insurance subs) will benefit from future profitability that may allude their peers who are “waiting it out”. In the first half of 2024, I believe banks were more willing to sit on the sidelines and wait for rates to come down. Now that there has been a change in both timing and severity on falling rates, I would think banks may look to fast forward changes to the balance sheet they otherwise thought would’ve already happened. Loss trades, de-levers, hedging strategies, etc.

Brian Love: Everywhere we go, we still hear about deposit generation being king, especially because of the rate environment and the fact that any well-run bank franchise is measured by its ability to generate organic funding. Is this still the big topic of discussion? How exactly are you advising banks on this strategy?

Scott Hildenbrand: Franchises are still valued on core deposits, that has not changed. The recent rate shift has shown us which swimmers have no trunks below the water. Generating core deposits is your value – this environment is putting that to the test. It should always be a big topic of discussion. Brian, I’d love to hear your thoughts on this.

Brian Love: On the topic of deposit generation, we’ve seen dozens of banks in nearly every geography – most of them more metropolitan – trying to lift out deposit teams and well-connected treasury management people, especially from the Signature, First Republic, and SVB aftermath. It’s tricky to pull this off, but some banks (Dime Community Bank, for instance) have been successful. Travillian has also had discussions with bank executives around where to look for new, bulky deposits (i.e., fintech partnerships – but also specific businesses like 1031 companies, escrows, law firms, title companies, etc.). Laying the correct infrastructure, technology, and user experience is paramount in landing these relationships.

Speaking of talent, we’ve noticed an uptick in bank Treasurer searches as well as CFO searches. Some from retirements and succession planning, but many due to a lack of – for lack of a better word – sophistication. What is your perspective on the current and future talent demands within the finance, balance sheet, and ALM roles at banks?

Scott Hildenbrand: These jobs got harder with more regulation, accounting changes, and market challenges. Couple that with tightening expenses (harder to pay up) and more options for remote work. Talent is becoming a problem in the industry. We face these challenges within the walls of our own company. More talent is going to have to be developed in house which will take time, resources, and training, but once developed, institutions will need to be competitive to retain their people. It is going to be more imperative that companies have ongoing succession plans. Given the difficult Banking environment, it seems there is no better time to bring in better talent

Brian Love: M&A has been slower for sure, although some exciting larger deals (South State/Independent, UMB/Heartland, etc.) have made headlines. What’s your take on M&A now and into 2025-26?

Scott Hildenbrand: When stock prices go up, M&A goes up. Marks on balance sheets have also hindered M&A and credit is still a question mark. If stock prices rise and/or rates fall = More M&A. If credit gets worse, stock market languishes, and rates remain high = no M&A. You could also include some of your commentary on volatility with the election and implications based on the outcomes of the election. Slower than expected in 2024, but optimistic on a go-forward basis.

Brian Love: Like me, you’re from the Philly area, and a fellow sports fan. Curious- what’s your best live sport memory?

Scott Hildenbrand: It was the 2008 Phillies World Series. I went back-to-back nights with an Eagles home game in between!

Brian Love: Mine was probably going to Game 4 of that same 2008 World Series. Let’s hope the 2024 Phillies have the same fate!

Travillian’s Banking and FinTech Practice provides Search and Talent Advisory services to depository institutions across the country. Established in 1998, the firm has built a unique platform that touches every corner of the industry. To learn more, click here, or get in touch below!

|

Brian Love, Head of Banking & Fintech

(484) 680-6950 | blove@travilliangroup.com |