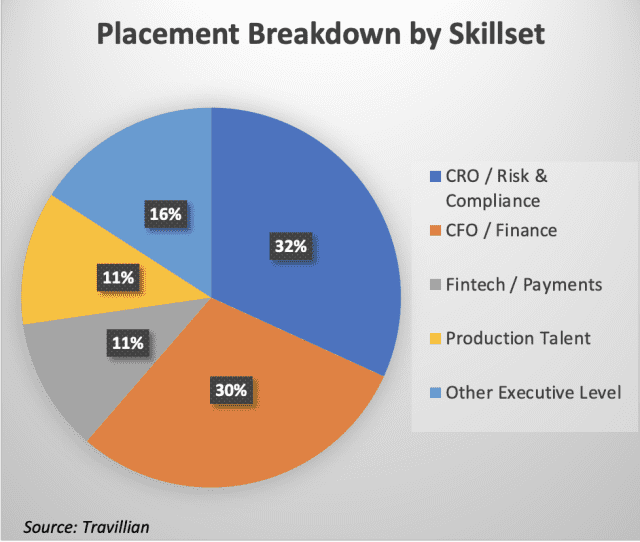

Since 2020, over 60% of Travillian’s talent mandates have been in the offices of the CFO or CRO.

Stop me if you’ve heard this before, but risk and finance talent is in high demand. At Travillian, over 60% of our searches since 2020 have been within these two skillsets. We’ll get to the risk and compliance trend in a future article, but what can be deduced from this data? The high demand for CFO talent has been driven by banks continuing to execute their succession planning – which is sometimes easier said than done due to the lack of qualified, prepared internal talent.

Travillian is an advocate and advisor to our clients executing a proactive plan around future retirements. The last two years have seen a decrease in mergers, which can sometimes provide the best exiting outcomes for ageing executives. With most acquisitive growth stifled, banks have been much more focused on internal talent assessment and creation of plans to sustain their executive benches and empower their emerging leaders. Two of our most recent CFO placements illustrate how this can be done expertly.

CASE STUDY: BayFirst Financial (NASDAQ: BAFN, based in St. Petersburg, FL, $1 billion in assets)

CASE STUDY: BayFirst Financial (NASDAQ: BAFN, based in St. Petersburg, FL, $1 billion in assets)

In early 2023, BayFirst announced the retirement of Tony Leo, the bank’s CEO, would happen at the end of the year. These triggered multiple elements of their succession strategy, including Bank President Thomas Zernick into the CEO role and the elevation of then-CFO and COO Robin Oliver into sole possession of the bank’s COO role. This created a backfill for a new CFO. Due to their familiarity with us (including three prior placements), Travillian was engaged. BayFirst was incredibly smart to build a year-long runway to execute this succession plan. Travillian’s extensive national search ended with the hiring of a very qualified Tampa, FL-area candidate, Scott McKim, who assumed the role in July 2023.

CASE STUDY: Chemung Canal Trust Company (NASDAQ: CHMG, based in Elmira, NY, $2.6 billion in assets)

CASE STUDY: Chemung Canal Trust Company (NASDAQ: CHMG, based in Elmira, NY, $2.6 billion in assets)

Knowing that their then-CFO, EVP & Treasurer, Karl Krebs, was desiring retirement, Chemung engaged Travillian in early Q1, 2023. With no clear internal successor, Travillian went to work finding the best and brightest external talent, on a national scale. Once several legitimate contenders were introduced, on March 27, 2023, the bank announced the future retirement of Karl Krebs. Soon after, Dale McKim emerged as a clear finalist, and the parties agreed to terms. The conclusive transition came into view as Krebs officially retired on June 30, 2023 with McKim starting his employment on July 1, 2023.

Both case studies demonstrate a few key fundamentals of successful CFO search and succession planning.

- Challenge yourself on the ideal CFO profile. Not all banks need the same skillsets, and what you needed in 2004 or 2014 is not the same as you’ll need in 2024. Avoid the non-negotiable of a CPA, if possible, as recent events have put a deeper emphasis on capital planning, liquidity management, ALM, and FP&A over straight accounting.

- Be considerate with existing talent. Make sure colleagues and co-workers are aware of intentions and outcomes. If an internal talent wants to be considered for the role, be respectful and open about their strengths and weaknesses.

- Have a realistic timeline. The above succession processes were years in the making, with participation from the Board level down. A diligent, comprehensive succession plan – including an external search – takes time. Once the search begins, Travillian estimates vetting and candidate introductions to take roughly 30 days. From there, it is dependent on the bank to keep the process forward.

- Run an efficient, sophisticated search process. Do not overload the process with unnecessary evaluators or interview steps. Include the right people who can help build rapport, tell the story, pique interest, and best judge character. Make sure internal and external communication is succinct and thoughtful, especially if your company is public.

- Use technology to your advantage. Tools like DocuSign, Microsoft Teams, or Zoom can help expedite the process in obvious ways.

Other 2023 CFO Placements by Travillian.

Other Selected 2023 Senior Finance Placements by Travillian.

Travillian’s Banking and FinTech Practice provides Search and Talent Advisory services to depository institutions across the country. Established in 1998, the firm has built a unique platform that touches every corner of the industry. To learn more, click here, or get in touch below!

|

Brian Love, Head of Banking & Fintech

(484) 680-6950 | blove@travilliangroup.com |