The link between stock performance and a hybrid business model

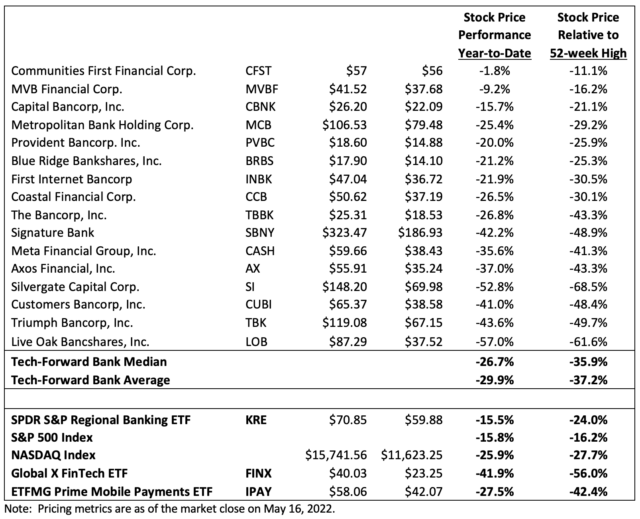

Since the conception of the Travillian Tech-Forward Bank Index last year, we’ve characterized these companies as standing at the forefront of the convergence between banking and technology. We’ve been deliberate in only considering adding companies to the list that originated as banks, and then transitioned to a sort of hybrid business model that we felt qualified the company as a leading “tech-forward bank”. We’ve avoided the reverse – companies that are “tech” at their base and looking to transition to a bank. As we’ve pointed out in prior reports, the tech-forward business model flourished during the pandemic, and investors in these companies were handsomely rewarded, amidst a broad-based recovery in bank stock prices, coupled with the market’s embrace of all-things growth (and particularly if said growth was in any way Fintech-related). Clearly, things are different so far this year. Market indices are down – the S&P 500 is lower by 15.8%; the NASDAQ is off by 25.9% — while the sectors we track as part of this analysis have been even more volatile. Bank stocks are down 15.5% — about in line with the S&P – but the year-to-date measurement obscures a peak-to-trough decline during the year of 24.0%.

A widely-followed ETF tracking payments companies – ticker IPAY – is down by 27.5% year-to-date, and by 42.4% since its peak late last year. But the most eye-popping of the bunch is the decline in FINX – an ETF that tracks global Fintech stocks – which is lower by 41.9% since the start of this year, and by 56.0% since late October last year. So, in that vein, how have tech-forward bank stocks performed? While performance is wide-ranging, tech-forward bank stocks as a group are lower by 26.7% since the start of the year based on the median performance of the 16 public companies measured, and by 29.9% based on the average performance. From the peak very early this year, the stocks are down even more, by 35.9% and 37.2%, based on the median and average, respectively. For the most part, this niche group of stocks has performed much worse than the bank sector, a little worse than pure tech, about in line with the payments companies, but better than pure Fintech, which makes intuitive sense, given the blended, hybrid nature of tech-forward banks’ business models.

Why have tech-forward bank stocks performed the way they have on a relative basis?

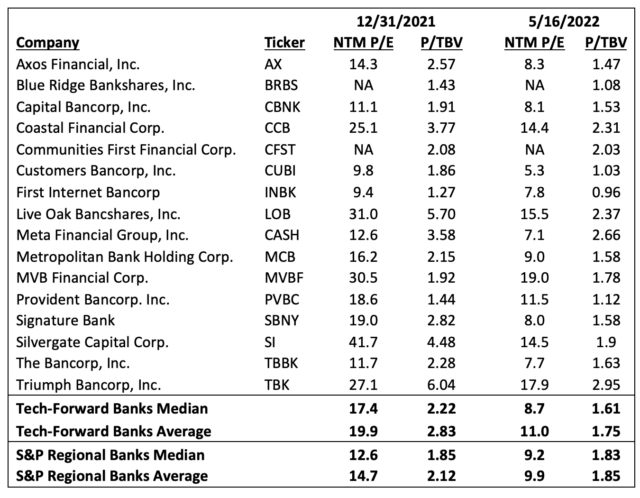

First, relative to other banks, the elevated valuations of tech-forward bank stocks left very little room for error as market conditions deteriorate this year. Indeed, heading into this year, tech-forward bank stocks traded at a median valuation of 17.4x forward EPS and 2.22x tangible book value, a five multiple P/E premium to the S&P Regional Banks, and a 20% premium on TBV. While a premium valuation in and of itself doesn’t tend to be an impediment to share price appreciation potential, it does create a higher bar of expectations, which can result in outsized negative reactions in share price if such expectations aren’t met. So, while fundamental performance by and large remained robust for the vast majority of these companies during Q1, an assorted mix of concerns, including unexpected inflation-driven expense growth, unfavorable shifts in the macro backdrop, and the resultant impact to niche segments of the market (crypto, credit underwriting, deposit betas, etc.), seemed to catalyze a reassessment of lofty valuation multiples.

Second, sentiment towards growth stocks – and particularly tech/Fintech-related growth stocks – has soured, to say the least, against the backdrop of sharply higher interest rates and inflation, which in and of itself lessens the appeal of growth-oriented companies. While this was flagged as a potential concern even early this year, as rates began a steady march higher, the general perception was that tech-forward bank stocks could thread the needle, in the sense that banks were perceived as prime beneficiaries of higher interest rates amidst a controlled inflationary environment, and robust economic growth, which helped to offset the “guilt by association” with technology and investors’ general aversion to growth-oriented companies. This was, in our view, the main reason why bank stocks outperformed earlier this year. However, several new developments quickly scuttled that notion, including the war in Ukraine, the brief inversion of the yield curve, the sense that inflation was moving to more of an uncontrolled state, and fears of economic recession. From that point, the sell-off in bank stocks accelerated, led by tech-forward banks that now were forced to contend with investor angst from all sides – the aversion to “tech” coupled now with bank-specific issues moving to the forefront of investor concerns.

Where do we go from here?

We looked at consensus EPS estimates for 2022 and 2023 for every tech-forward bank at the start of this year compared to where those estimates sit today. Given the roughly 30% decline in tech-forward bank stock prices, on average, so far this year, one might logically assume that fundamental performance and the outlook for these companies had materially changed from what was expected heading into the year. Interestingly though, EPS estimates for these companies have increased, on average, by 9% for 2022 and by 20% for 2023, relative to consensus expectations at the start of the year. In other words, EPS prospects have brightened considerably even as the stocks have cratered! If industry analysts and investors (including this one) had been provided a glimpse at the start of the year of actual EPS revisions but without the benefit of having seen any other news (war, inflation, recession fears, interest rates, etc.), we think it’s safe to say that none would have guessed that the stocks would even be lower, let alone down by 30% on average, from the start of the year. This example should illustrate the extent to which macro forces and anticipatory fear of what might be ahead has driven stock price action so far this year, rather than actual fundamental performance and company-specific EPS outlooks. We think this uncertainty is unlikely to abate anytime soon. That said, there are a few considerations worth noting:

- First, tech-forward bank stock valuations have rationalized at a quicker pace than peers, and these stocks now trade at a discount to the S&P Regional Banks, despite materially better top and bottom-line growth prospects. As compared to a five multiple P/E premium at the start of the year, tech-forward banks now trade at a half multiple P/E discount to regional peers, and a 12% discount based on tangible book value (compared to a 20% premium on TBV at the start of the year). While in our experience, valuation in and of itself is rarely a catalyst for share price, the valuation backdrop is now such that any spark of good news could serve as a powerful re-ignitor for tech-forward bank stocks.

- Second, several of these companies are among the sector’s most asset-sensitive banks, meaning they should disproportionately benefit from higher interest rates, and/or their primary balance sheet growth vehicles are not as correlated to the interest rate cycle as their traditional bank peers. So IF the economy avoids recession, IF inflation subsides, IF we see some measure of stability in the fixed income market, and IF economic growth can be sustained – admittedly quite a few IF’s – these stocks should be positioned to perform well.

- Third, tech-forward banks are not a monolith, in the sense that investors have optionality to parse the business models of these companies to focus on niches they believe will fare better and avoid those they think are more likely to struggle. For instance, investors can hone-in on the “crypto banks” or the BaaS (Banking as a Service) specialists, or the pure deposit growers, or the payments-focused companies or a combination thereof. In other words, there should be select opportunities for standout performance, even in an extended, more challenging market environment.

- Fourth, tech-forward banks could remain the preferred vehicle for growth investors in a more challenged market environment, vis a vis the pure fintech lenders, which in our view are ill-suited to weather a sustained economic downturn, given the lack of core funding, and, for most, limited history in navigating through a true credit-led downturn.

The bear case in our view is simple. Should current fears that have driven stock prices lower fully materialize – whether it be aggressive Fed policy and inflation that tips the economy into recession, escalation of geopolitical issues, or a whole host of other macro issues that mostly sit outside the control of the companies in question, then these stocks are likely headed lower, perhaps significantly so, though with many tech-forward banks now trading at discount multiples, it’s difficult to say whether or not they would continue to underperform. Our hunch is they likely would, given that an economic downturn would likely spark credit concerns that would probably center, at least initially, on those companies that have grown at a faster pace in recent years.

Loved or hated, but likely never ignored

At the end of the day, the longer-term convergence between banking and technology remains intact, though the pace of that convergence could slow somewhat in a downturn scenario. While we can’t say with any degree of certainty how the next 6-12 months are likely to play out, we’re very confident in our belief that convergence is indeed where banking is ultimately headed, with any near-term blips likely to translate to longer-term opportunity for those that are best able to weather the storm.