The business model at investment banking firms serving the regional and community bank sector over the past few decades has worked very well, helped by an extraordinary level of deal activity, with only brief periods of interruption along the way (i.e. the financial crisis of 2008; the COVID pandemic last year, etc.). The most successful firms had prominent investment bankers assigned to specific regions of the country, with the charge to essentially blanket their assigned region with “coverage”. This entailed developing relationships with the key decision makers at as many regional and community banks within their designated coverage area as possible. These key relationships, overall market intelligence, and dogged persistence in understanding and serving the needs of their clients, enhanced by the regional and/or national credibility of the firms that employed these bankers, was often a formula for success.

Banks would sometimes skip geographies in pursuit of M&A opportunities. These transactions tended to reflect a broader, fairly consistent trend, such as in the years just prior to the Great Recession, when banks in slower growth markets in the Midwest were attracted to faster growth dynamics in Florida. For instance, as a particular trend would develop, it was not unusual to see a Midwest-focused investment banker either establish relationships in another market like Florida, or pair up with another banker at their firm that specialized in that particular state or region of the country.

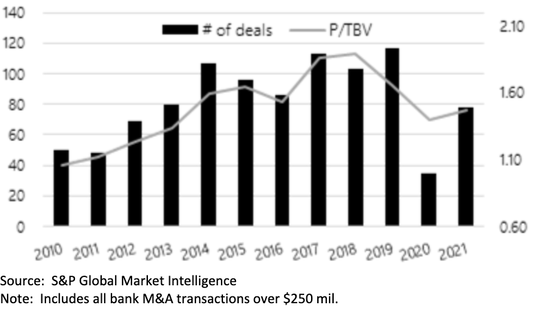

Bank M&A Transactions By Year

But change was already underway and has since been accelerated by the pandemic. It would be easy to ascribe all of the changes we are seeing in the business models of banks (and the vendors and advisors that service the sector) to their lived experiences during the COVID-19 pandemic and its aftermath. However, the more accurate characterization is that change was already underfoot and has merely been accelerated by the pandemic.

There are a few notable trends increasing the attractiveness of, and enabling banks to execute on, M&A transactions that are non-contiguous from a geographic perspective. These include advances in back-office technology and operational processes, the encroachment of fintech (and conversely, banks interest in this area), and the increasing scarcity factor of banks based in faster growth markets. Continued advances in technology, the ever-increasing prevalence of fintech as a “need to have” rather than a “nice to have”, changes in customer preferences, and the ways in which we live and work during and post-COVID have simply exacerbated and accelerated changes that were already underway.

The bottom line is that we are seeing increased M&A activity between banks and other financial services companies that is more geographically agnostic, and we think we will see much more of this as the M&A cycle evolves. A few notable examples help to illustrate our contention: Pre-pandemic, the announcement that CA-based Lending Club Corp. (LC) planned to purchase MA-based Radius Bancorp, Inc.; and then during and post-pandemic, announcements such as CA-based SVB Financial Group’s (SIVB) purchase of MA-based Boston Private Financial Holdings (BPFH); New York Community Bancorp’s (NYCB) planned purchase of MI-based Flagstar Bancorp Inc. (FBC), and on the smaller side, MO-based Enterprise Financial Services Corp.’s (EFSC) pending acquisition of CA-based First Choice Bancorp (FCBP).

As we see it, this dynamic represents both a challenge and an opportunity for the advisory firms (and the investment bankers) that service the bank sector. On one hand, the old formula will still work handsomely for at least the foreseeable future. We believe that we are on the cusp of an M&A wave that should rival any in the sector’s quite active history. Many management teams and Boards are aging out, lack adequate succession, and haven’t made the requisite adjustments or investments (or simply don’t have the know-how or interest) to thrive in the post-pandemic era. Many of these banks are likely to seek out merger partners through the traditional process. In other words, they will contact their trusted investment banking partner, who will help them identify larger or similarly sized peers (based in local or contiguous markets) that might have an interest in an acquisition. The acquirer would then perform a similar analysis to identify potential synergies, primarily revolving around cost savings and growth opportunities, as they also sort through the typical social considerations.

But for other acquirers (and some targets), M&A during this cycle is likely to take a different form and for these companies, the advisory process will require an altered approach. For banks with a fintech-oriented or tech-forward strategy, a more holistic view of the acquirer’s opportunities and challenges will likely prove far more valuable from an advisory perspective. This necessitates an advisor having an in-depth understanding of the strategic planning process of the company (and how best to execute on it) and will be more appealing than the services offered by the regional investment banker with strong relationships solely within the acquirer’s or target’s immediate market area.

Now, we acknowledge that strong relationships will still matter very much. Many banks already handle the early-stage negotiations and social challenges themselves and bring in their favored investment banker near the middle to end stages of the process to help bring the ball to the finish line and execute the transaction. But if that’s the role that investment bankers are to play in the new M&A landscape, it’s only a matter of time before fees and operating margins deteriorate further.

That being said, there is also enormous opportunity for those that adapt, to the point where idea generation can and should result in enhanced fees for advisors. This is due to the wider “playing field” for idea generation (nationwide and across sectors, rather than the more limited regional focus) and what we presume will be lesser competition from firms and individual investment bankers that aren’t capable of making said transition.

Join us in the weeks ahead for a webinar that will delve into this topic in more detail. Our next webinar will feature several individuals that will help shed light on the adjustments that various investment banking firms are making to reflect this new reality, alongside community bankers that will speak to our audience on this same topic, but from their unique perspective. Stay tuned for details in the coming weeks!