While I have resided in bigger cities since high school, I grew up in a small town in the South. Fishing, either from the shore or a small boat was part of the small-town culture, as were community banks. Fishing as a pastime in small communities has not changed much, but banking surely has. Many family-run banks have disappeared due to succession issues or a bigger bank offering its P/E on an acquiree’s earnings stream and crediting some portion of the cost savings. Banking is a mature, consolidating industry in which scale is perceived to drive results.

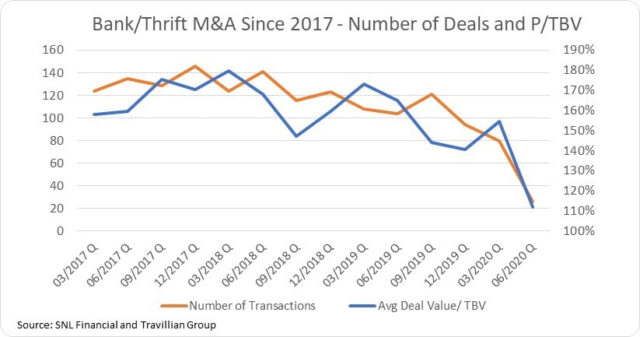

It is logical to expect M&A to accelerate again from here given industry changes at a more rapid pace, revenue challenges, and the over-arching need for more efficiency in a digital world. However, M&A has been terribly slow in 2020 due to intense focus on current loan portfolios and present customers, as well as the obvious difficulty that banks face in evaluating others’ portfolios when the future is so uncertain. Terry Earley, CFO and SEVP of Veritex Holdings (VBTX) indicated that “price discovery is just not there yet, but people that execute on their own credit book will be the winners coming out the other side and there will be opportunities”.

For bank executives, this begs the question whether to spend time working on potential consolidation opportunities/partners and what M&A will look like when it eventually returns. Jeff Davis, Managing Director with Mercer Capital, indicated that until a potential buyer has confidence their own portfolio is in good condition, there is not going to be much M&A activity. A great quote from one of his colleagues is, “Don’t let other people’s problems become your own”.

I believe M&A activity is not likely to return this year and maybe not even part of 2021, absent deals like BDGE/DCOM that were in the works before the pandemic arose or very small deals that make both community banks stronger to endure the environment.

Scott Dueser, Chairman, President & CEO of First Financial (FFIN), stated that, under present conditions, a bank “would have a hard time figuring out what [it’s] buying” and that staying the course is the best path for now. However, he also suggested that many banks could be thinking “my bank’s going down in value and I want out” and that prices are “going to be a lot cheaper”.

What Bank M&A Looked Like the in the Past. Having analyzed hundreds of deals over the years the following topics usually determined whether M&A outcomes were successful:

General framework:

- What is the pro-forma contribution of earnings and ownership for each party?

- Were the social/cultural issues worked out early in the diligence process?

- Do the expected cost and revenue synergies exceed the premium paid?

- Is there a strong strategic rationale for the combination?

- Does the buyer have a track record/history of integrating deals?

For the seller: Is the buyer growing as fast as the seller, or is the buyer willing to pay for the present value of execution of the business model?

For the buyer: Does the deal enhance the overall attractiveness of the franchise, either via market share, balance sheet, or growth prospects? What is the risk of permanent dilution?

Over the last three years, the KRE bank index (-34.7%) underperformed banks within the index that have been active in M&A over the period by -226bp. M&A by itself does not appear to explain much outperformance relative to stories like FFIN or PB. By the way, within the 130 names in the KRE, the R² typically runs at ~90%. [1] Investors could fairly argue the “cattle all move about the same pace”. Confidence in earnings power/growth and credit quality trump all other variables eventually.

[1] R² indicates how much variation of a dependent variable is explained by independent variables. It can be interpreted as the percentage of a security’s movement that can be explained by movements in a benchmark. An R² of 100% means all movements of a security are completely explained by movements in the index.

Can Buyers Become Too Enamored? In my opinion, some bank executives look at deals and get excited by what could be called the “capitalized value of cost savings”, but this is at risk of valuation dilution if investors feel the cultures do not mesh or the pro-forma balance sheet quality is diluted. Getting into a new “growth” market is sometimes overbought. The competitive landscape is usually tougher and getting buy-in from the seller’s employees in a new market without losing talent can sometimes lead to less growth than expected.

What Will the M&A Trend Be Upon Re-Emergence? Acquirors lamenting challenging top-line revenue growth will simply look for banks (regardless of growth prospects) with high efficiency ratios in similar/nearby markets to mine bottom-line EPS growth. Terry Earley indicated that “scale is going to be more important than ever, as scale and cost saves will be the most significant lever left to pull”.

While the term “vampire M&A” may be harsh, I feel that it captures the essence of what buyers will be doing. I doubt that they will be nurturing franchises for longer-term growth opportunities. They will mostly be looking for bottom line EPS growth derived from meaningful cost savings of acquisitions to appease investors. It is frequently more palatable to be aggressive with another’s expense structure than one’s own. There is also the question about the potential sellers themselves – what they have been as a bank in the past may not be a winning recipe on the other side of this pandemic.

There are presently 45 banks with $10-$20B in assets in the US, and the median efficiency ratio expectations for 20’/21’ for the group are 58%/60% (partly due to revenue pressure). Only four banks have efficiency ratio expectations in the 40s and only 11 total below 55% for 2020E. These banks can probably make their own decisions about the future. Many of the others could be pressed to come up with reasons for independence – something to think about in 2H20 while there is still time to manage Y/Y expense comparisons.

The BBT/STI deal that created Truist Bank is not that old, but it is worth bringing up a key piece of the rationale behind the deal: spreading needed technology spending over a bigger base. I foresee that there will be a big resurgence of M&A at some point, perhaps in 2H21. Terry Earley stated that “we need to be bigger with more revenue diversification to afford the technology spend and to have the resilience that investors are going to want”.

Looking at Some Deals, Just for the Exercise. There are quite a few regional banks in the SE, and they are frequently bandied about among investors looking for pairings. I am not suggesting any of the following deals take place but merely think the possible math outcomes (that do not reflect CECL accounting, etc.) are interesting to think about as we wait for more certain times.

The Travillian Group’s Banks and Credit Unions practice provides Search and Talent Advisory (TTG|Align) services to depository institutions across the country. Established in 1998, the firm has built a unique platform that touches every corner of the industry.

Our search and advisory professionals focus on building long-term, trust-based relationships with Boards, Executives and HR professionals. They assist our clients in the hiring of high quality, hard to find talent and provide full-life cycle consulting in such areas as succession management, leadership development, employee engagement, recruitment strategies and compensation.